The state setoff program is a method public agencies of the State of Iowa may use to collect past-due (delinquent) debts (for example, child support payments) that are owed.

The state setoff program matches people and businesses who owe delinquent debts with money that is owed to those people and businesses (for example, an income tax refund). Sources of funds available for setoff include, but are not limited to, tax refunds, casino and sports wagering winnings, State-issued vendor payments, and Iowa Lottery winnings. To the extent allowed by law, when a match occurs, the Iowa Department of Revenue (IDR) withholds or sets off money to apply toward the delinquent debt. State of Iowa Setoff Program requirements are outlined in Iowa Code section 421.65 as enacted by 2020 Iowa Acts, House File 2565, and Iowa Administrative Code rule 701—Chapter 26.

Are you a public agency interested in participating? See the Participating Agency Information section below to learn more.

List items for Setoff Program

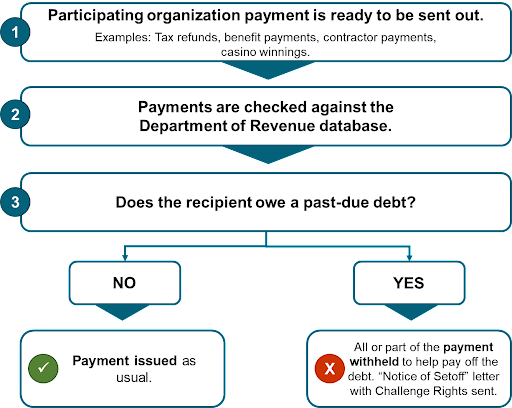

If you owe an overdue debt to a public agency participating in the State Setoff Program, the agency may send information about your debt to the program.

When you are going to receive a state payment or other payment eligible for setoff, a search is performed on the database to see if you have debt placed in the program.

If your debt is in the program, the Department holds back money from the payment to pay your debt. This process is known as a "setoff”.

When the Department takes money from your payment, a letter is sent explaining what we did and providing a challenge opportunity.

What happens before agencies send debt to setoff?

The debt must be “qualifying debt” before it is submitted to the Setoff Program. Processes to ensure that debt is qualifying debt vary by public agency and debt type.

A summary of ”qualifying debt”, as defined in Iowa Code section 421.65(1)(d) follows: Any debt assigned to the Department of Health and Human Services (HHS) or which child support services is otherwise attempting to collect; any debt in the form of a liquidated sum due, owing, and payable to the clerk of the district court; and any liquidated sum certain, owing, and payable to a Public Agency, with respect to which the public agency has provided the obligor an opportunity to protest or challenge the sum in a manner in compliance with applicable law and due process. See 2020 Iowa Acts, HF 2565 for the complete definition.

For example: An agency may require a letter sent to the debtor at the name and address on file for the debt. The requirements of that letter may be to tell the debtor about the debt (type and amount), that the agency intends to refer the debt for setoff, and what rights the debtor has to resolve the debt situation. This letter may provide the debtor opportunities to pay the debt, enter into a payment agreement, or dispute they owe the money to the agency.

Viewing Debt

There are two ways to view outstanding debt. You will need the Letter ID or confirmation number from the letter you received in order to view additional information.

If you were notified about a setoff when you collected your casino or sports betting winnings, visit GovConnectIowa and select View Qualifying Debt for Setoffs.

Setoff Challenge Rights

If you received the Notice of Setoff of Public Payment letter from the Iowa Department of Revenue in the mail, visit GovConnectIowa and select Respond to a Letter. The Notice of Setoff letter explains how to challenge the setoff. You have 15 days from the date of the Notice of Setoff letter to challenge the setoff in writing.

There are three (3) types of challenges:

- Debt is not qualified

- Mistake of identity of the obligor

- Mistake of amount owed

The Department will respond to your challenge within 10 business days from the date the challenge was received in writing.

Credit Vendor – An agency or entity who submits funds to the Setoff Program

Credit Vendor Name – The legal name of an agency or entity who submits funds to the Setoff Program

FEIN – Federal Employer Identification Number

Setoff – Money collected to pay an overdue debt to a public agency

Debt – Monies owed to a public agency

Debtor – A debtor is a person, not including a public agency, whose debt is not yet qualified

Obligor – A person, not including a public agency, who has been determined to owe a qualifying debt

Public Agency – A board, commission, department (including IDR), or other administrative office or unit of the State of Iowa or any other state entity reported in the Iowa annual comprehensive financial report, or a political subdivision of the state, or an office or unit of a political subdivision. See HF 2565 for complete definition.

The original program was developed in the early 1970s, and allowed the Iowa Department of Revenue and Finance to withhold income tax refunds for liabilities owed to the Department. By the late 1970s, refunds were allowed to be withheld for other state agencies, and in 1989 the program expanded to payments issued to vendors.

In 2003, the Department of Administrative Services (DAS), began managing the program. Over the next six (6) years, it grew to incorporate debts from additional public agencies such as cities, counties, municipal utilities, and community colleges. It also allowed offsets of casino jackpots and other winnings. The allowance of sports wagering winnings was added in 2019.

House File 2565 returned this state program to the Iowa Department of Revenue. The change will take place in November 2023 alongside The Department’s Tax Modernization Rollout 3.

The questions on this web page address the State of Iowa Setoff Program, the program that withholds money to pay for a debt. If you have questions about a specific debt, refer to the Notice of Setoff letter received.

Why did I get less money in a payment (for example, my income tax refund) than I expected?

Your payment may be less because you owed an overdue debt to a public agency. If that is the case, you should have received a “Notice of Setoff” letter. Visit GovConnectIowa and select Respond to a Letter.

The law says that the Iowa Department of Revenue may withhold money to satisfy an overdue (delinquent) debt. The official term for withholding money from a payment is "setoff".

Please note that a payment agreement does not prevent the Department of Revenue from applying payments to your outstanding balance due.

Can you help me?

If your payment was reduced because you owed an overdue debt to a public agency, you were sent a Notice of Setoff letter stating your money had been setoff and the name of the setoff agency with contact information. You must contact the setoff agency for additional information related to debt owed.

The Iowa Department of Revenue cannot answer questions related to your owed debt or refund your setoff money. You must contact the agency you owe money to discuss further.

Can the State Setoff Program take my federal tax refund?

No. If your federal tax refund has been held, you need to contact the Internal Revenue Service (IRS). Learn more about how the Treasury Offset Program (TOP) works. The Iowa Department of Revenue’s Setoff Team is not provided any information by the Federal Government and is unable to respond to questions regarding federal tax refund offsets. Contact the IRS at 1-800-829-1040 or visit Where’s My Refund?

My spouse owed an overdue debt. We filed a joint tax return. Our refund was reduced to pay my spouse's debt. What must I do to get my portion of the refund?

You may request a division of a jointly or commonly owned right to payment within 15 days of the date of your Notice of Setoff. Visit GovConnectIowa and select Respond to a Letter or email IDRChallenges@iowa.gov.

When does a debtor leave the Setoff Program?

A debtor stays in the Setoff Program until the agency that sent the debt to IDR removes the debt from the Program.

The agency might tell IDR to stop collecting if the debt has been paid in full, if the debt is subject to a bankruptcy stay, or if other reasons justify pausing or stopping collection.

Debt Recovered

Iowa Code section 421.65 allows the setoff of casino and sports wagering winnings, lottery prizes, public agency overpayments, vendor payments, and state tax refunds.

Public Agency Participation

A signed agreement between the public agency and the Iowa Department of Revenue is required for participation. Only public agencies, as defined in Iowa Code 421.65(1)(b), are allowed to participate in the State of Iowa Setoff Program.

Requirements to Participate

The initiating event for participation is submission of a Setoff Enrollment Application with Qualifying Debt Questionnaire (341.68 KB) .pdf .

Following the application, all participating agencies are required to:

- Have a signed memorandum of understanding (MOU) on file with the Department

- Place qualifying debt in the program

- Keep their balances up to date

- Recertify their debt at least annually

- Upload all documents needed for setoff challenges

Training Tutorials:

- Completing the Memorandum of Understanding

- Understanding the Enrollment Application and Qualifying Debt Questionnaire

Questions? Contact idr-setoffs@iowa.gov